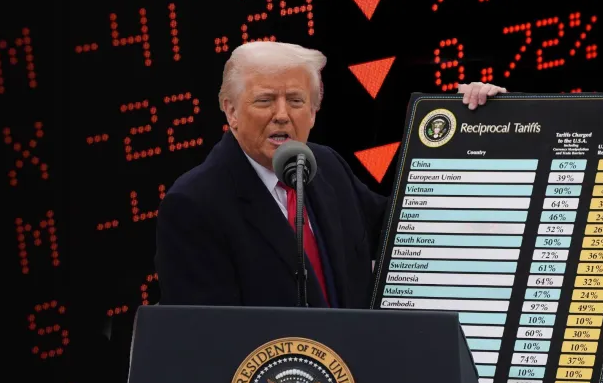

In classic fashion, former President Donald Trump’s return to the global economic stage has made waves—not just politically, but financially. His renewed call for tariffs on imported goods, particularly from China and other major trade partners, is already triggering volatility across sectors and shifting investor sentiment.

Whether you support or oppose these moves politically is irrelevant here. From a wealth strategy perspective, what matters is how the market reacts—and where capital flows as a result.

Let’s look at how these new tariffs could affect the market in the short to medium term, and more importantly, where investors should be focusing their portfolios in the face of a more protectionist global environment.

Tariffs are, by nature, inflationary. They increase the cost of imported goods, which either gets passed on to the consumer or absorbed by companies—hurting margins. The last time Trump introduced large-scale tariffs (2018–2019), we saw:

Expect similar dynamics now, with a few key differences: this time, AI and automation are far more mature, the world is post-pandemic, and global supply chains are more fragile and expensive than ever before.

Supply chains will tighten again, and multinational manufacturers will likely face squeezed margins. Companies dependent on cross-border trade could face slower earnings growth and higher operating costs.

Investment takeaway: Be cautious with broad exposure to global industrials or multinational consumer discretionary sectors—unless they’ve already moved toward supply chain automation or reshoring.

If tariffs hold, capital may rotate into companies that produce, source, and sell primarily within their home market—especially in the U.S. and Europe.

Investment takeaway: Consider ETFs or stocks focused on domestically centered mid-caps, regional infrastructure, and reshoring beneficiaries.

Geopolitical tension and policy uncertainty will increase volatility. But that often creates buying opportunities in sectors with secular growth tailwinds.

And that brings us to perhaps the most important point:

Amid global trade shifts and rising economic friction, one sector stands uniquely insulated and capable of thriving: Artificial Intelligence.

Here’s why AI is positioned to outperform 99% of other sectors in the coming 12–24 months—regardless of tariffs, interest rates, or political tension.

Tariffs create cost pressure. AI offers efficiency. Companies that embed AI into operations—logistics, resource planning, customer service—can offset rising costs faster than their competitors.

In a world where input costs are rising, efficiency becomes the new margin.

Unlike industrials, AI companies are less dependent on physical supply chains. Software, data, and compute can move globally with less disruption. That means fewer dependencies on trade policy and better scalability.

AI has a unique network effect. The winners—the platforms with the most data, the best models, and the most enterprise integrations—are pulling ahead at exponential speed.

While other sectors suffer from margin erosion, AI leaders are experiencing:

Investment takeaway: Owning AI today isn’t about speculative bets. It’s about being on the right side of technological infrastructure. That includes not just big tech names, but also chip manufacturers, cloud infrastructure providers, and vertical AI companies solving real-world problems.

For investors looking to navigate this changing environment, here’s a high-level strategy Jonathan would recommend:

Shift core exposure toward companies with:

These companies will handle tariff-induced friction better than global-facing peers.

Especially in AI, automation, data infrastructure, and cybersecurity. Innovation is the one sector that continues to outperform even amid macro tension—because it solves the very problems tension creates.

With inflation still lingering and uncertainty increasing, idle cash is more dangerous than volatility. Use ETFs, short-duration bond ladders, or automated portfolios to stay agile—but invested.

Volatility can create panic or opportunity. Investors who focus on what matters—cash flow, adaptability, and innovation—will see this as a moment to buy into strength, not retreat in fear.

Every policy change creates winners and losers. Tariffs may slow trade, pressure supply chains, and add noise to markets. But they won’t stop the deeper currents reshaping the global economy.

AI, automation, and digital transformation are not short-term trends—they’re long-term redefinitions of how value is created and delivered.

The real risk for investors in 2025 isn’t being exposed to volatility. It’s being underexposed to innovation.

Now is not the time to pull back. Now is the time to invest smarter.

Every investor has a different starting point. Let’s find yours—and build from there.